Payroll tax estimator

Employee share percentage does not apply to all employees. Then use the employees Form W-4 to fill in their state and federal tax information.

Income Tax Formula Excel University

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

. Certain additional regulations apply for employees who are resident in New York City. All foreign national employees any non US. Looking for a quick snapshot tax illustration and example of how to calculate your tax return.

Deduct the amount of tax paid from the tax calculation to provide an illustration of your 202223 tax refund. Pay your land tax assessment. To change your tax withholding amount.

To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option. Citizen on payroll must create and maintain a Glacier individual record. Payroll and expense reports.

This will be messy and will mean penalties on late filing and payment of taxes. H and R block Skip to content. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

If youve ever worked Down Under you probably paid tax and are due an Australian tax refund. Then enter the employees gross salary amount. This 2021 Tax Return and Refund Estimator provides you with detailed Tax Results during 2022.

Americas 1 tax preparation provider. 1 Calculate your reasonable salary and run the payroll for 2019 filing Forms 94x W-2 etc. Free for personal use.

The Community Safety Payroll Tax became effective January 1 2021. IRS Tax Withholding Estimator. You have several options.

Request extra time to pay your land tax. Payroll Tax and Reporting - W2 Tax Benefit and Retirement Questions. View your land tax records online.

UI needs improvement. IRS tax forms. Once you have the adjusted annual wages you can use the tax table found on page 6 of IRS Pub 15-T and calculate the annual federal income tax amount.

Estimate your tax refund with HR Blocks free income tax calculator. Payroll taxes are rarely a targeted form of tax relief although it has happened in the past before the CARES Act went into effect. The tax usually shows up as a separate line on pay stubs.

If you claim exemption from withholdings your employer wont withhold federal income tax from your wages. Ask your employer if they use an automated system to submit Form W-4. Self-Employed defined as a return with a Schedule CC-EZ tax form.

Submit or give Form W-4 to. Employee Tax Withholding forms. Then get Your Personal Refund Anticipation Date before you Prepare and e-File your 2021 IRS and.

Reliable customer support. And payroll taxes or pre-tax deductions. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate.

Taxes File taxes online Simple steps. A temporary 2 reduction in the employee side of the Social Security payroll tax was in effect in 2011 and early 2012. Final deductions are dependent on actual enrollment selections employment classification employment status eligibility rules.

IRS Withholding Estimator Tool. 409 747-8078 Option 2 Fax. Calculate your total tax due using the tax calculator updated to include the 202223 tax brackets.

Use your estimate to change your tax withholding amount on Form W-4. After You Use the Estimator. FAQs on the 2020 Form W-4.

Generation of reports in real-time. Figure the tentative tax to withhold. 19 2014 requires the IRS to establish a voluntary certification program for professional employer organizations PEOs.

Welcome to our Australian Tax Refund calculator. The tax is collected by the New York State Department of Taxation and Finance DTF. This was not a deferral though it was a reduction of the tax rate.

Estimate Your 2022 Tax Refund For 2021 Returns. Payroll tax relief. WPRO-12 In addition to your current IRS tax withholding which is most likely based on your latest W-4.

Its never been easier to calculate how much you may get back or owe with our tax estimator tool. 247HRM allows you to send SMS alerts every time you need to notify your employees of any changes or developments. 1 online tax filing solution for self-employed.

WPRO-11 Enter the date you will submit this W-4 Form to your employer or payroll department. Finally you can make any needed tax adjustments for dependents and determine the amount of tax per check. People trusts and estates must pay the New York City Personal Income Tax if they earn income in the City.

Account for dependent tax credits. Or keep the same amount. For more details on how the Community Safety Payroll Tax will be administered see Administrative Orders 44-20-05-F applicable for tax periods January 1 2021 to December 31 2021 and 44-21-07-F applicable for tax periods after January 1 2022 amends Admin Order 44-20-05-F.

International Payroll and Taxes. PEOs handle various payroll administration and tax reporting responsibilities for their business clients and are typically paid a fee based on payroll costs. Statutory compliance and income tax.

Please check with your payroll office if you are unsure of your premium share percentage. Input any additional pay like bonuses or commissions. The Tax Increase Prevention Act of 2014 enacted Dec.

This calculator is FREE to use and will give you an instant Australian tax refund estimation. Payroll unemployment government benefits and other direct deposit funds are available on effective. Tax Refund Estimator For 2021 Taxes in 2022.

409 747-7904 Mail Route.

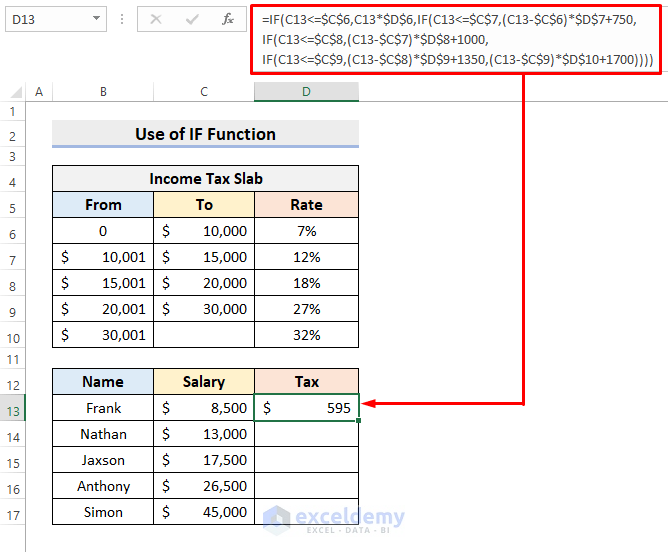

How To Calculate Income Tax In Excel

How To Calculate 2019 Federal Income Withhold Manually

Income Tax Formula Excel University

Income Tax Formula Excel University

How To Calculate Income Tax In Excel

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Calculation Of Personal Income Tax Liability Download Scientific Diagram

How To Calculate Income Tax In Excel

How To Calculate Federal Income Tax

Income Tax Formula Excel University

Excel Formula Income Tax Bracket Calculation Exceljet

Calculate Income Tax On Salary Sale 52 Off Www Ingeniovirtual Com

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel Using If Function With Easy Steps

Inkwiry Federal Income Tax Brackets